Z$ZT is my amateurish attempt at understanding the financial side of Platforms. You may want to head to the excellent commentaries on valuations of both traditional and platform businesses by the guru of valuations Aswath Damodaran.

Before we dive in further, if you are reading for the first time, please subscribe for a weekly email discussing Running Platform Marketing Life.

AND if you are a friend of the RPML, do share it with others. You can add more of your friends to the Community of Platform’ed by using the following link.

Do share your feedback on this newsletter if you have not done it yet.

And if you are still wondering about Z$ZT, stay till the end.

DTW

During the Week, Zomato’s Initial Public Offer (IPO) was subscribed over 38 times. I hope my Zoman friends can now cash out their Employee Stock Ownership Plan (ESOPs) and perhaps look for greener pastures. Please visit the OTM section at the end of newsletter if you would like to explore interesting opportunity at TRICE.

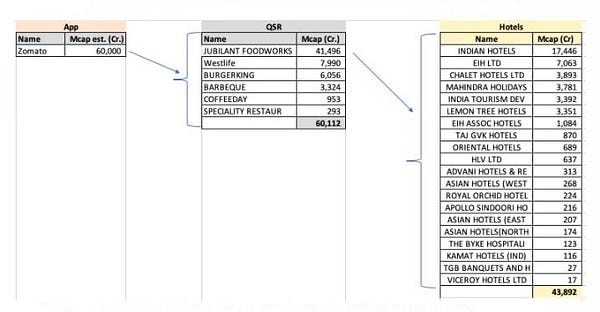

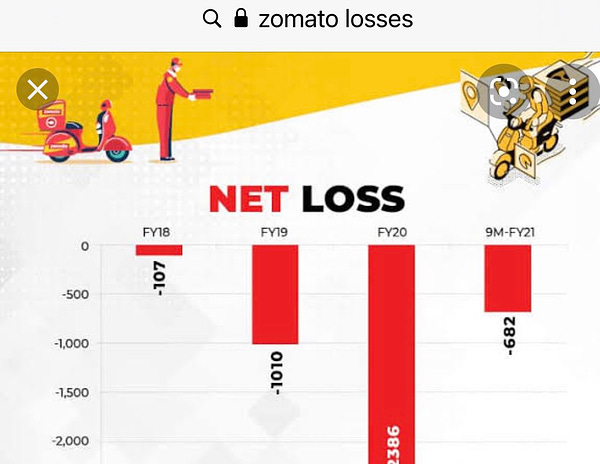

In the meanwhile , Harsh Goenka - Chairman - RPG Enterprises fired the first salvo comparing the market capitalisation of hotel chains and Quick Service Restaurant with the loss making Zomato’s proposed Market Capitalisation.

And then followed it up with another satirical one

To determine long term sustainability of platform businesses, we might want to look at three different cost metrics-

User Acquisition costs: Also called customer acquisition costs or simply CAC, this is an important reason for burgeoning losses in the initial growth stage of platforms.

Operating Expenses for Existing Customers: This is another tricky expense as platforms might end up spending more to retain the customer till they achieve end-user network effects. This also means that the platform would continue burning cash to encourage users to transact on the platform.

There is an interesting episode in the movie Social Network where Sean Parker advises the young co-founders of Facebook on what could make their company worth a billion dollars- Keep the party going!

Corporate Expenses for running the platform ; These may include R&D, G&A and depreciation. Many platforms continue to spend big dollars to retain best talent and more often than not spend on acquiring latest technologies.

Of course, this entire debate could be pitted in terms of Value Creation vs Value Extraction. There is always an ambiguity about where the value is created and from where it could be extracted. And perhaps that’s where there seems to be a difference between the DotCom bubble of 1990’s vs today’s eye-popping valuations. Most of the current valuation are driven by enterprise tech/SaaS and the funding seems to be used to build product and get to product-market fit. Also, money at least in the public markets looks like ending up with perceived winners following the Winner Takes All (WTA) syndrome in platform businesses.

This old tweet which keep resurfacing whenever there is a discussion about Total Addressable Market (TAM) is an insightful way to look at the valuation of platforms from a revenue potential perspective. What if the advent of a platform fundamentally changes the demand and supply in any industry by expanding the supply and demand exponentially. Some platforms ride on the tails of a trend but some might end up setting a trend. Many saw the following explanation by Finance Minister about struggling automobile sector as a lame excuse but it does point to some changes in consumer behaviour which expand the TAM of platforms as there are increasing returns to scale.

The biggest beneficiary of Zomato’s IPO may be Uber investors who sold Uber Eats business for 10% stake in Zomato and now would be laughing their way to bank. Also, platform like Zerodha have expanded the investor base especially millennials who might end up investing in Zomato.

To conclude, Zerodha $e Zomato Tak (Z$ZT) has been a fantastic journey for the Indian Platform Business Ecosystem.

OTW

Over the Weekend, bunch of runners from PeeranCheruvu Runners did the final recce for our upcoming BrownTown Ultra 2021 in association with BrownTown Spa and Convention Centre run by Sanketh Reddy.

If you are in Hyderabad around Independence Day (14-15 August 2021) weekend and would like to feel the exhilaration of an Ultra Marathon, please follow the BrownTown Ultra 2021 Event Website.

“If you want to run, run a mile. If you want to experience a different life, run a marathon.

If you want to talk to God, run an ultra.”

―Dean Karnazes, Ultramarathon runner who ran 50 marathons in 50 different US states in 50 consecutive days

Stay Safe and Get Vaccinated ASAP.

I Love You

Shailendra

OTM

Opportunities through MountainSpeak are available for TRICE Community for marketing and sales leaders.

Trice has seen some significant growth over the last couple of months in S-Commerce and team is excited on the potential of this idea and it’s growth. They are looking to expand to about 700 Communities in the next 6 months. And to do this, Co-founders are looking to work with like minded individuals who believe in the idea and are interested to learn and grow along with them. They are a passionate team and extremely motivated to build Trice as India’s largest platform for Neighbourhood Commerce. Should this be of interest to you and if you have any questions, please reach out to Naveen.

Sir, Loved the different perspectives shared about Zomoto's IPO. Quite insightful :)

Just curious and to cross check the over subcription by 37 times of Zomatos's IPO is the result of the cheap cash being offered to retail investors at zero percentage interest !